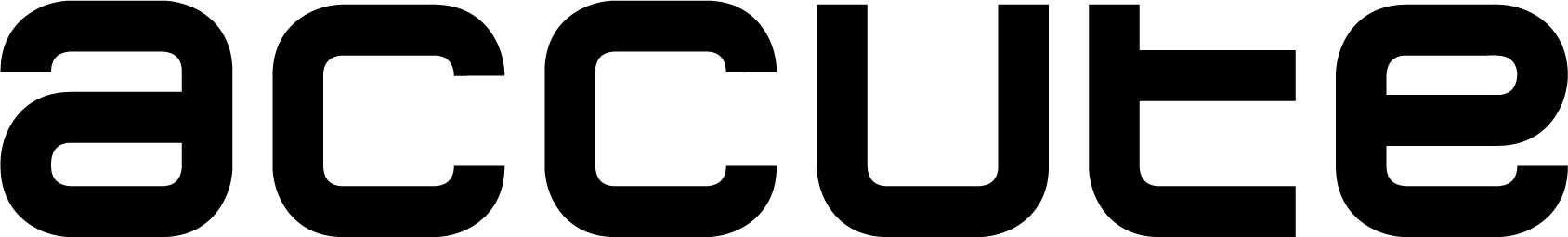

We have enabled small and medium-sized entrepreneurs to finalize liability, property, and business interruption insurance truly easily – at the time when they are busiest.

Insurance for the real needs of entrepreneurs

The work of smaller and medium-sized entrepreneurs is increasingly demanding. Markets in various sectors are becoming saturated and competition is high. This forces this group of entrepreneurs to look for business solutions that are clear, fast, and reliable. This applies not only to purchasing, sales, or production, but also to insurance. The previous issues in this area were lengthy processes, sometimes the necessity to visit a branch, lack of transparency, and unclear policy comparisons. Our aim was to simplify this entire insurance process for entrepreneurs and help them focus on what sustains them—running their business without stress.

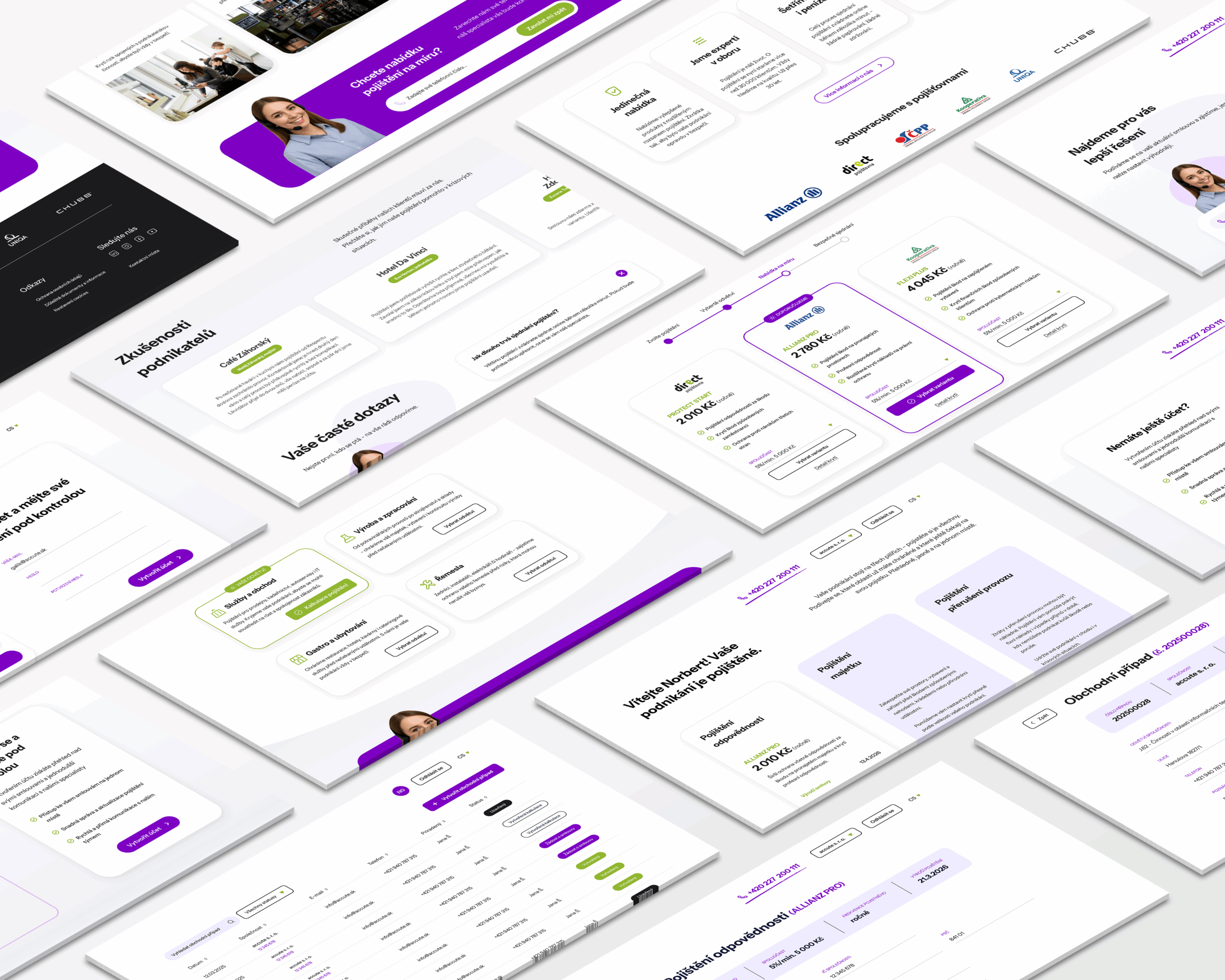

Therefore, for the largest insurance broker in the Czech Republic specializing in business insurance, we designed a modern web interface for concluding insurance contracts for small and medium-sized enterprises. The platform enables a fully digital process for taking out liability, property, and business interruption insurance—from entering input parameters and calculating premiums to finalizing and paying for the contract.

The solution also includes a client zone for easy management of concluded policies and an administrator zone for the call center, serving as a tool for cross-selling and up-selling. The goal of the platform was to significantly simplify the acquisition process, enabling scalable online sales of business insurance.

Insurance is for everyone, so we adhered to accessibility standards according to the European Accessibility Guidelines (WCAG, EU directive).

If you also need a stable and modern platform for your service, contact us at +421 910 157 410 or sales@accute.sk.

What are the EU accessibility directives?

The Web Accessibility Directive (WAD) has applied since 2016 to the public sector. This means all government and municipal websites, mobile apps, and related services must be accessible for people with disabilities. The aim is to remove digital barriers and create inclusive public digital infrastructure across the EU.

The European Accessibility Act (EAA) has been in force since 2019. It extends accessibility obligations to the private sector, covering e-commerce, banking services and e-banking, e-books, telecommunications, kiosks, electronic devices and more. It is also based on the POUR criteria (Perceivable, Operable, Understandable, Robust). Non-compliance may lead to sanctions.

Why was this important for our project?

Accessibility responsibility

Financial services are often used by people with diverse abilities—the web interface must be legible, usable, and compatible with assistive technologies (screen readers, keyboard).

Legal compliance and reputation benefits

Although a private platform, it falls under the EAA. Compliance with WCAG 2.1 AA and EN 301 549 was mandatory from the outset.

A proactive accessibility approach enhances brand image, builds trust, and creates a competitive advantage.

Specific UX/UI implementations

- Sufficient text contrast, responsive buttons, logical focus order for keyboard navigation, ARIA labels, and alternative text for images.

- Adhering to POUR principles so the platform is:

- Perceivable: easily perceivable,

- Operable: fully operable via keyboard and assistive tools,

- Understandable: clear and predictable,

- Robust: reliably functioning with diverse technologies.

We implemented EU accessibility directives as a quality design feature, not merely a legal requirement. This ensured the platform is fully inclusive and reliable.

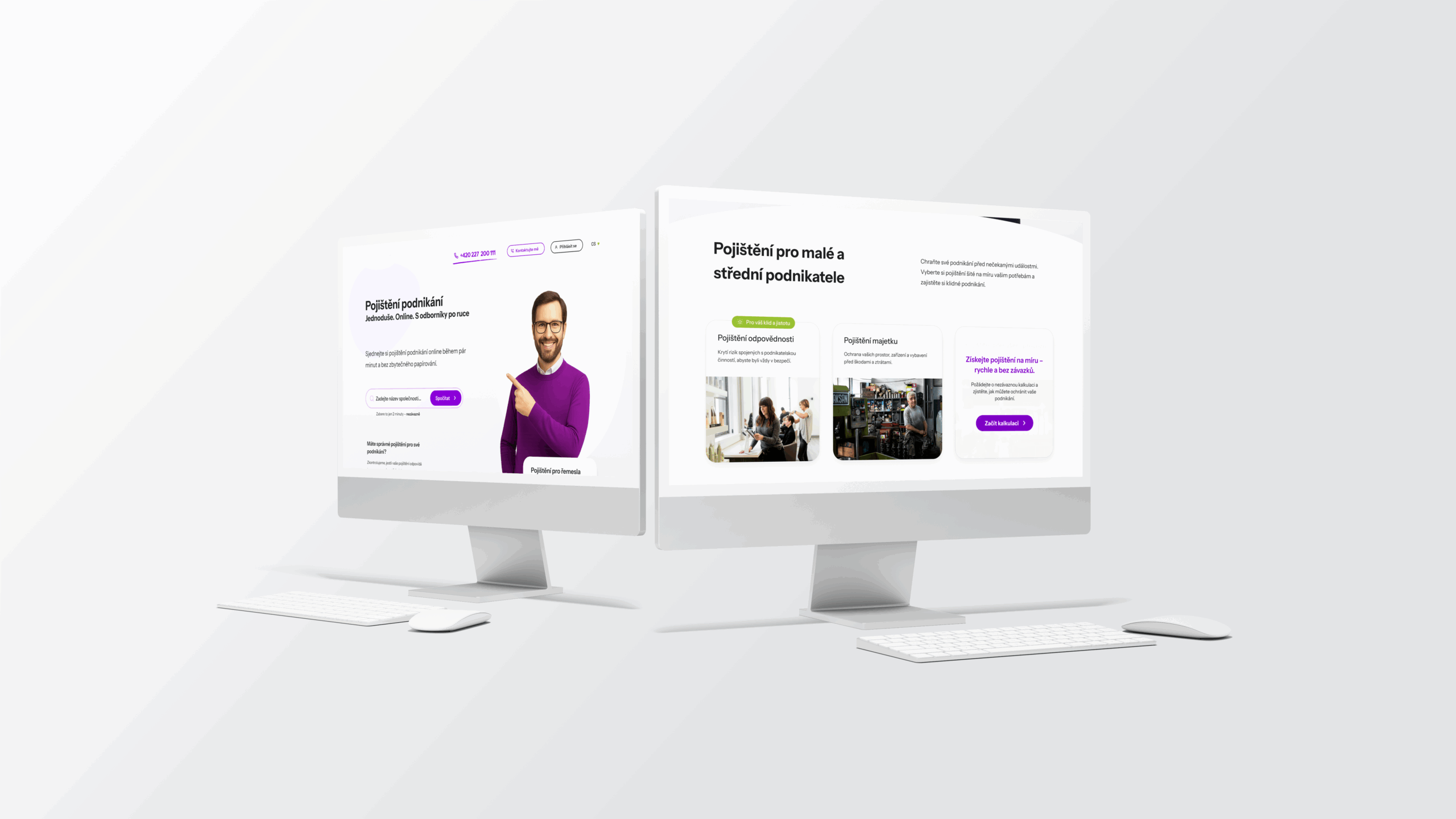

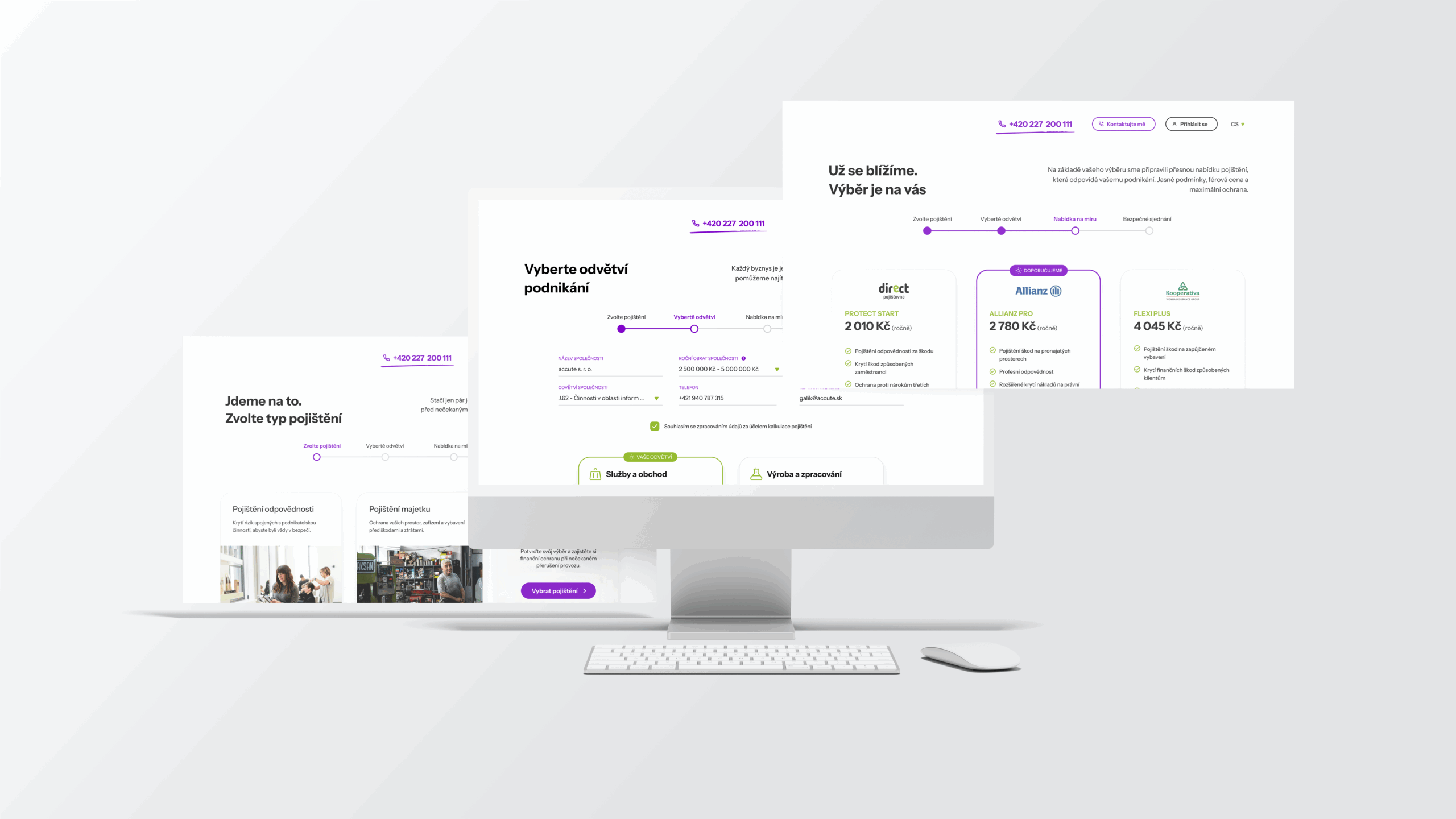

One of the main project goals was to simplify and speed up the process of finalizing an insurance contract, which in traditional models often takes several days and may require a branch visit or multiple parties.

In our solution, the entire process is digital, clear, and accessible to everyone—including users with special needs.

From days to minutes

We designed the process so that:

- Fast – what typically takes 2–3 days can now be done in a matter of minutes;

- Accessible – fully compliant with EU accessibility guidelines (WCAG);

- Simple and stress-free – even for less tech-savvy users.

In addition to the UI design, we prepared the technological concept ensuring smooth platform operation, secure data processing, and seamless integration with insurers.

Cloud infrastructure

The platform is built as a cloud solution to easily handle high user volume, dynamic growth, and seasonal peaks.

The concept includes:

- Scalability – ability to adjust performance based on demand;

- High availability – uninterrupted service even under heavy load;

- Secure document handling – e.g. for auditing insurance contracts.

The infrastructure was designed with stability, security, and future extensibility in mind.

Insurer integration and internal APIs

Since the platform processes quotes from multiple insurers, it was necessary to design an internal API layer that enables:

- Communication with different insurer systems—each with unique requirements, data formats or integration modes;

- Future flexibility—new insurers or products can be added without impacting the platform core;

- Fast quote comparison and automated premium calculation—reducing contract finalization time.

Internal APIs also ensure secure data exchange, consistency between systems, and seamless integration of the new platform into the broker’s existing robust IT infrastructure.

Security and data protection

Financial and insurance services deal with sensitive data, so we prioritized security from day one:

- Encrypted communication – all data is transmitted and stored encrypted;

- Access control and authorization – the system differentiates access levels for end users, call centers, and admins;

- GDPR compliance – the design was reviewed by data protection lawyers to meet legal requirements;

- Audit trails – every action in the system is logged for future review.

Security standards were embedded in the design from phase one to prevent potential risks related to online data processing.