A holding company of more than twelve companies was struggling with hundreds of invoices issued and received for different companies during the month and was looking for a way to solve the different accesses to each company for its employees and pay hundreds of invoices with one click for all companies. We took on the task and created a customized invoicing application called InvoiceLine.

Identified client need

A holding company operating dozens of subsidiaries found themselves in a situation where they received and issued hundreds of invoices per month, and the process of recording, approving and paying them was chaotic and inconsistent. The goal of the project was to get the invoices of all subsidiaries into one application, with the aim that individual users only have access to selected companies and that their access rights are clearly defined. The user should have the right to register or approve the invoice, or modify and delete it, and only selected senior employees should have the right to pay invoices.

Payment of invoices should be as simple as possible and it should be possible to pay dozens of invoices at once so that senior employees do not waste time manually creating payment orders in their bank’s internet banking. Therefore, the necessity of implementing the SEPA generator into the newly emerging application was a matter of course.

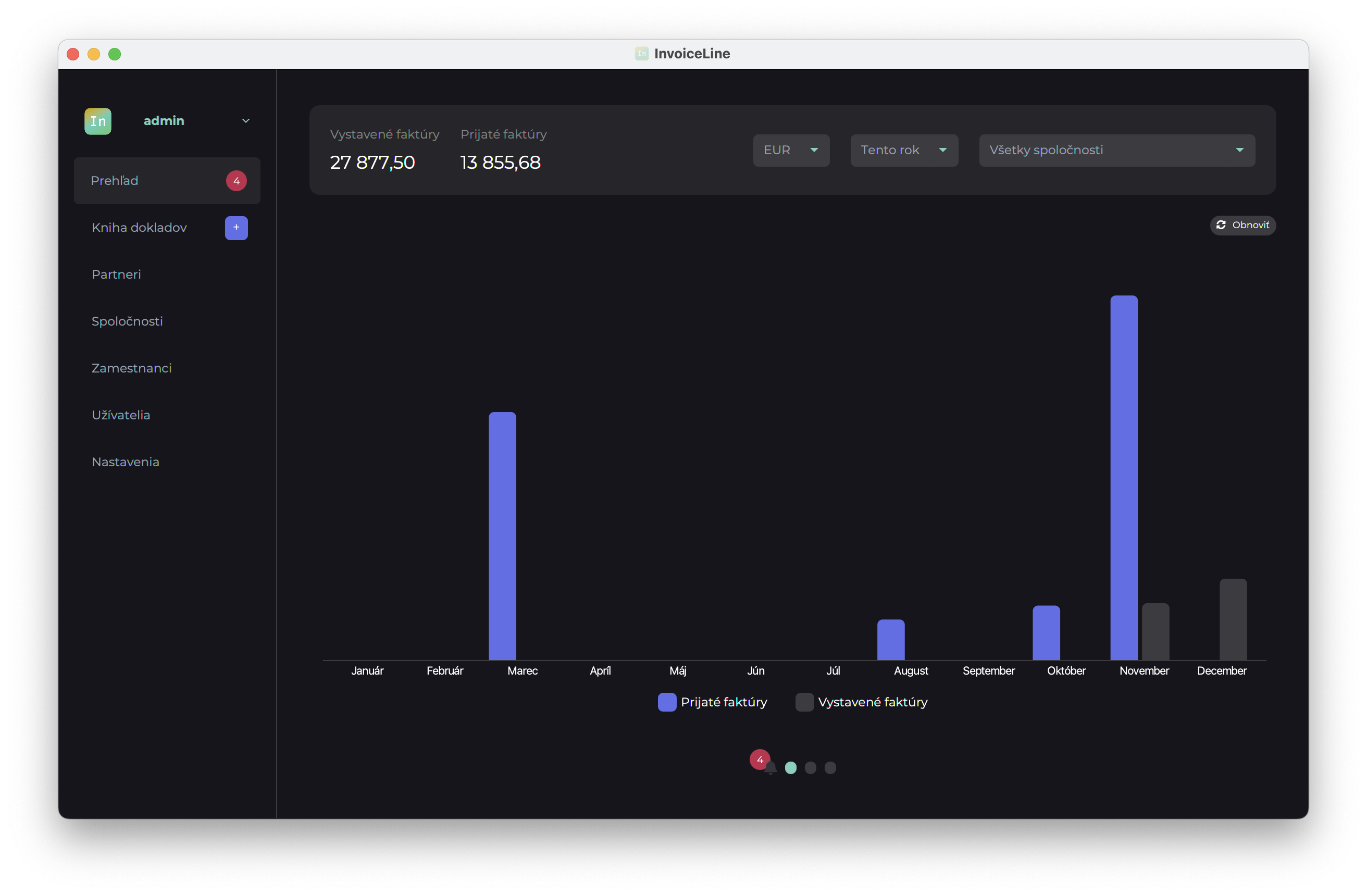

Overview of payments and documents

Our domain at accute is the ability to bring solutions to clients even in cases where they do not have a clear idea of what the final result should look like and to design user-friendly functionalities for them.

We delivered the first prototype of the application to the client within three weeks. An important requirement was data security, and therefore, of course, it had to be a solution that would be connected to the client’s database and not a cloud solution. In such cases, customers do not have to worry about the risk of misuse of data, or their sale, and the security and ownership of the resulting data is exclusively in the hands of the client.

Part of the invoice registration is the creation and management of individual companies for which invoices are issued, as well as the management of users with the possibility of setting their rights. For each user, it is possible to set which company’s invoices they can see and what they can do with individual invoices. He may have the right to create, delete, approve or reimburse them. The client’s special request was the so-called “incognito” invoice flag. These are invoices that could only be seen by selected users – for example, they could be payments related to employee salaries, or important invoices that only company management can see.

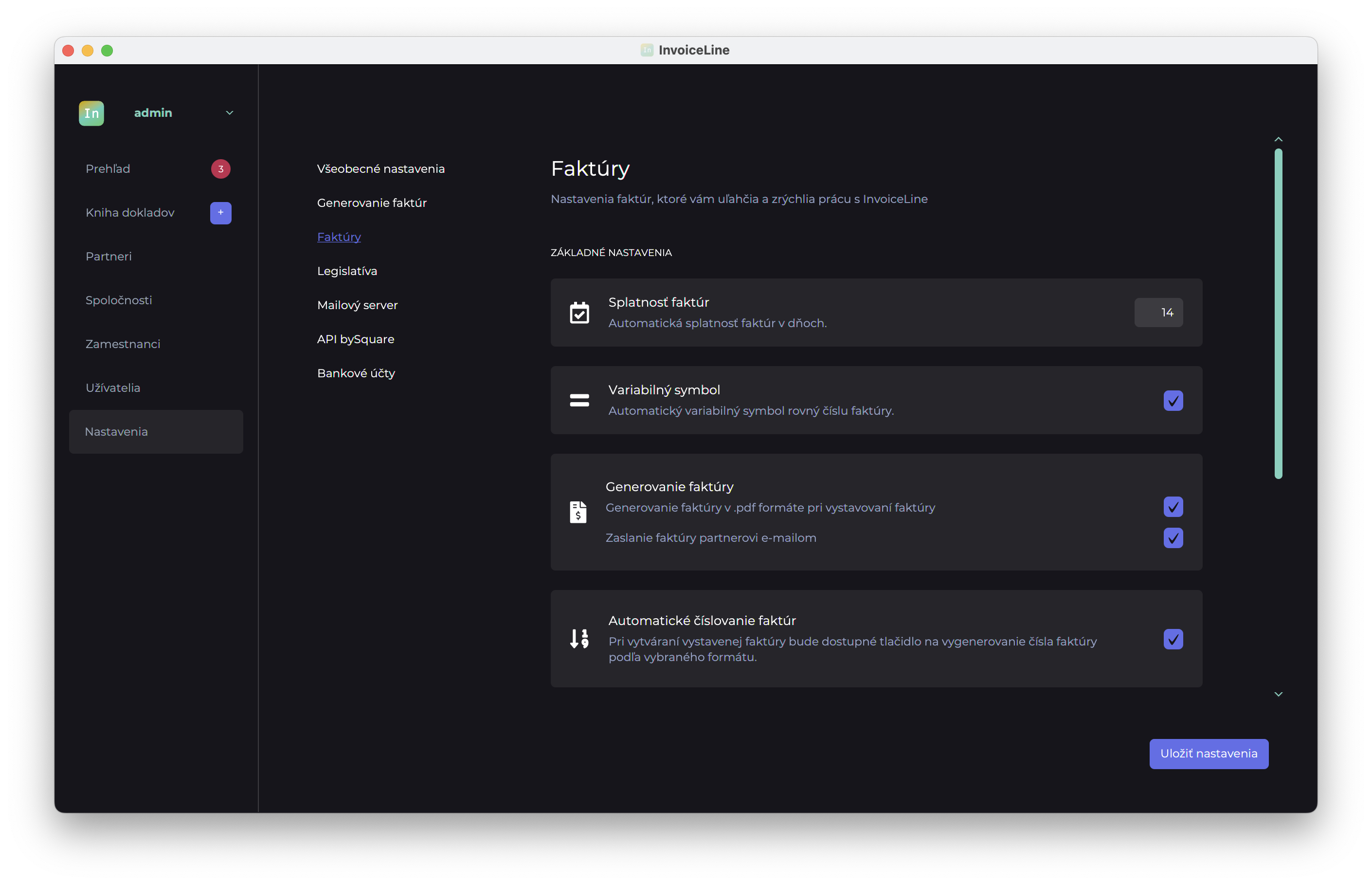

As a matter of course, the registration of scanned documents to the invoice with the possibility of moving selected files to the invoice, as well as the generation of the invoice in .pdf format. The client has the option to choose from several invoice visuals along with the option of automatically sending the invoice by email to the customer.

One of the most important requests of the client was the implementation of mass payments, i.e. the possibility of paying several invoices at once. The record keeping of invoices would not be anything special if the accountant or administrative worker had to pay each received invoice separately. Therefore, InvoiceLine has the option to select an unlimited number of invoices that are ready for payment and thus generate a mass payment order that can be imported into the internet banking of the client’s bank by simply moving it and paying hundreds of invoices at once with one signature. InvoiceLine automatically identifies that the user has selected invoices for several companies and thus creates a separate payment order for each company for payment from the default account in the given currency.

Payment of invoices using QR codes is becoming a standard these days, but despite this, there are still many partners who issue invoices without a payment QR code. The company’s management wanted to deal with such situations as well, and therefore InvoiceLine includes the option to generate a payment QR code even for such received invoices where the client’s partner did not include them himself. By simply scanning the QR code in the mobile application, the company’s management can make the payment flawlessly.

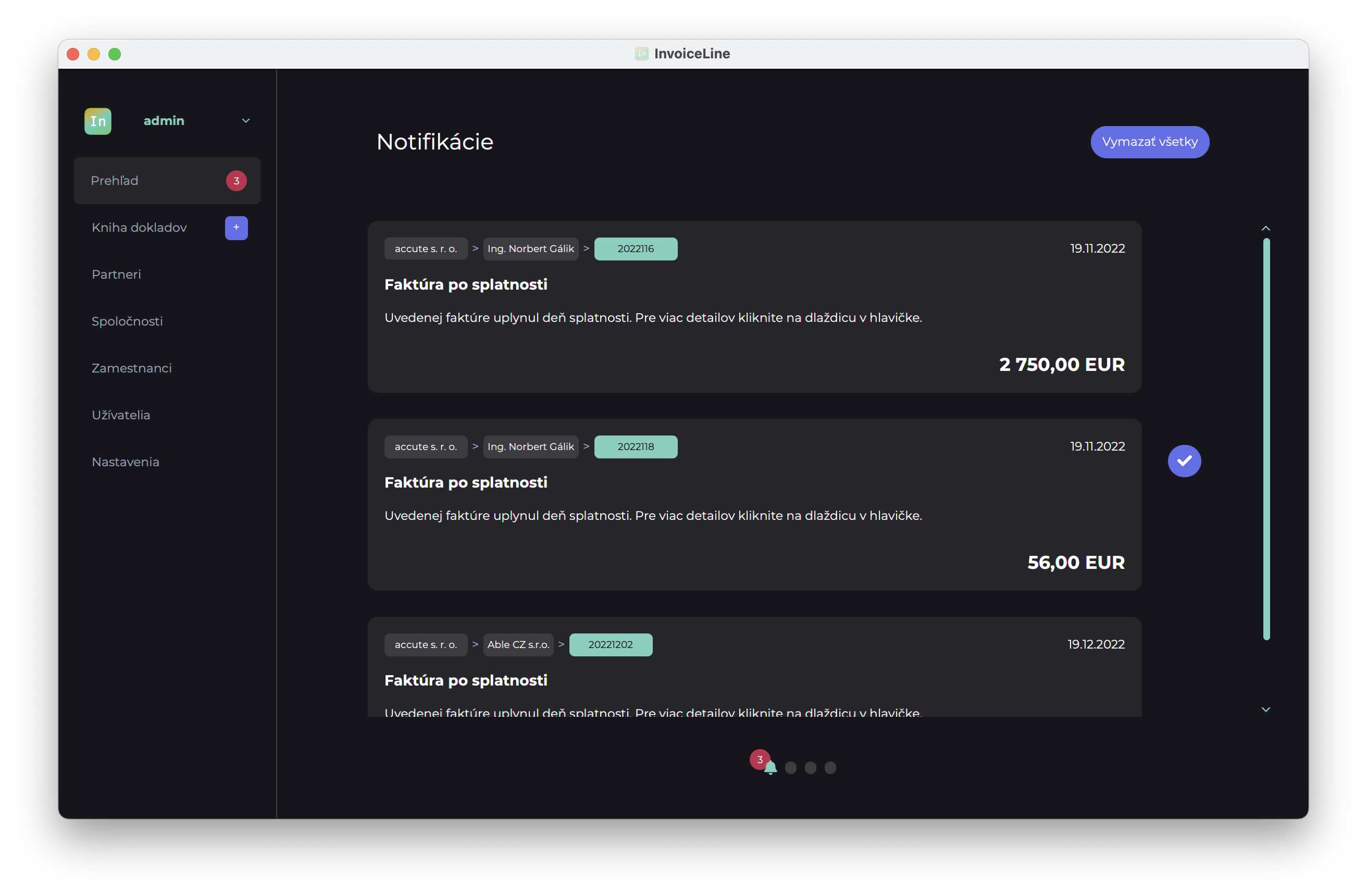

Users have clear information about new invoices, overdue invoices or invoices awaiting approval in a clear bulletin board, where they have a notification module along with an overview of the volume of invoices by month, volume by customer or invoice status.

Special requirements

The application is created modularly and is thus an open platform for possible future client requirements depending on changing needs. Whether it was adding a discount to invoices or automatically matching invoice payments thanks to a connection to the API of the client’s bank, any change within the purpose of the application can be implemented.