For several years now, we have been a long-term partner and supplier of the overall software background of one of the five largest securities traders. An important part of the operation of any company in the 21st century is reliable software, especially its main part used by employees at the headquarters, which is powered by applications for clients or partners. We bring you a brief overview of the financial company’s key software, which ensures its day-to-day operation and communicates with multiple partner systems.

Complexity of the system

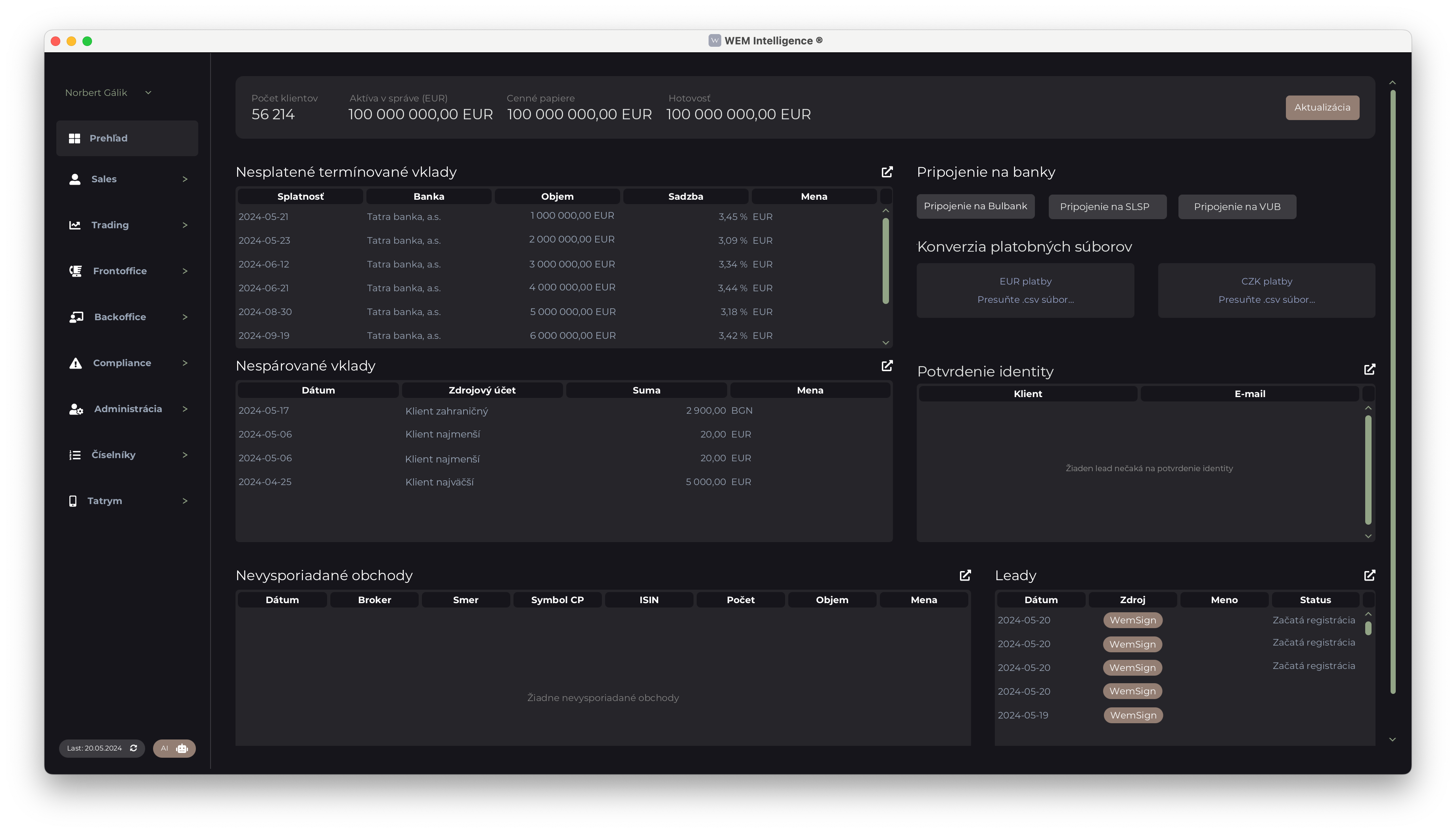

When developing key applications for large companies – especially for companies in data-sensitive sectors such as finance – the biggest challenge is the complexity of the application itself. Part of the solution for our client was the development of modules for several departments that connect to each other and at the same time communicate with other company applications that are used either by our client’s end customers or its partners. Whether it is a module for client management, a module for portfolio managers who trade in securities or a module for the compliance department whose task is to control all transactions from an AML perspective – we always had to maintain an overview of the entire solution and understand how the software used by individual users.

There are several key modules in the application, we will introduce some of them in this case study. We will focus on the module designed for the portfolio of managers, or traders who perform hundreds of trades on the financial markets every day, to a module for the management of individual clients and a module intended for the legal department, or the compliance department, which is responsible for operating the company in compliance with all laws and guidelines.

Automation of trading

One of the main activities that securities brokers carry out is, of course, securities trading. It is an operation that takes over a considerable amount of time for traders or portolio managers. Therefore, it was very important for us to develop a module for our client so that it was as automated as possible and could thus save hundreds of hours of manual work and complicated calculations, as well as improve the overall trading operation within the company.

The application thus became a custom-developed algorithm for automatic securities trading, which was optimized for the needs of our client according to the processes setup in the company. This complex algorithm performs several tasks – not only can it calculate for thousands of clients at once which security should be sold or bought according to predetermined weights in specific investment products, it can also identify the possibility of trading securities between clients, generate instructions and trades in fractional pieces and so on. At the same time, the algorithm also takes into account various other requirements of our client, such as the creation of a cash reserve (predetermined percentage of available cash) on client accounts or the automatic processing of signed requests for the transfer or withdrawal of client cash.

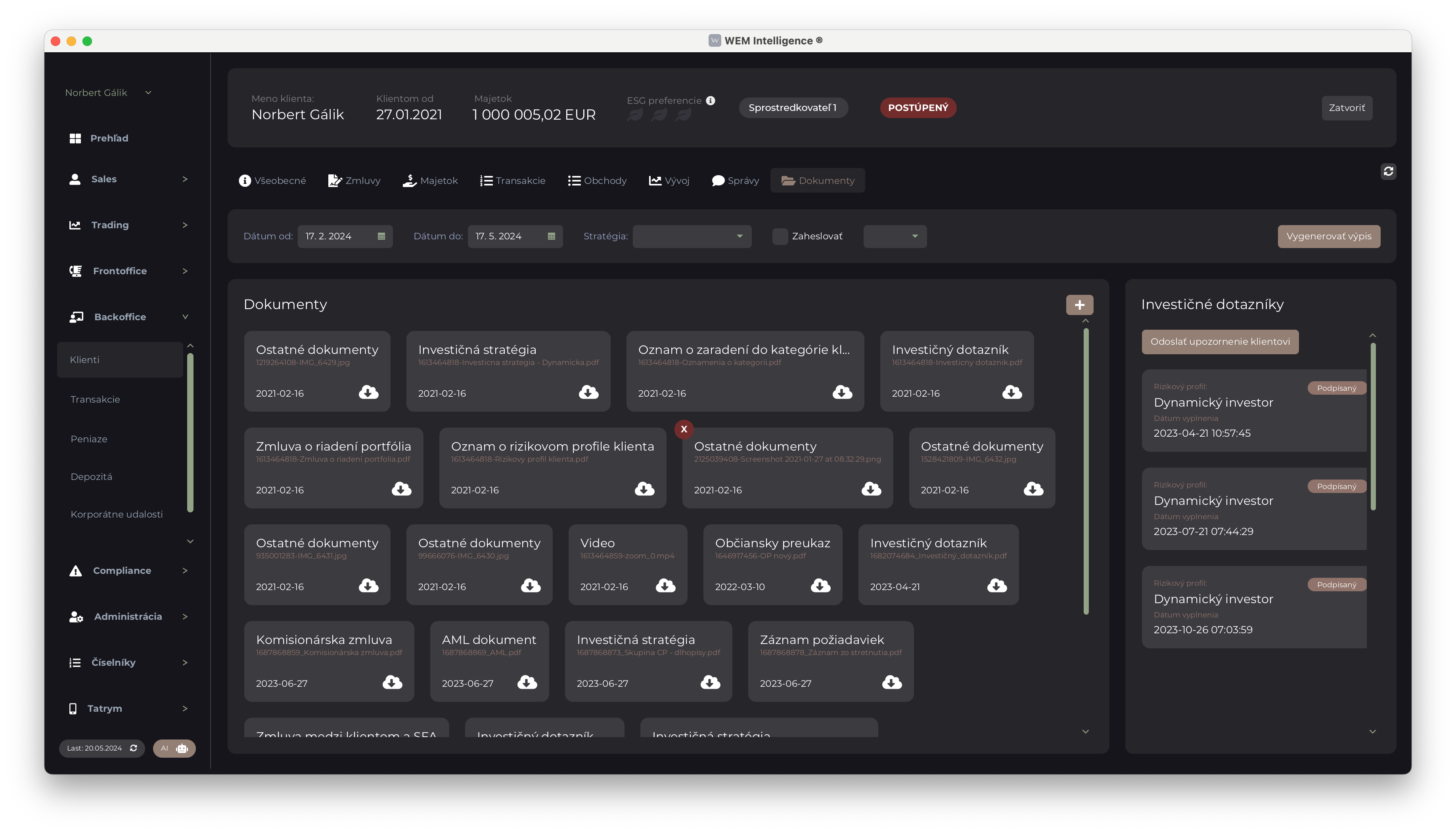

Managing finances for clients entails the need to precisely record the details of individual clients, which is why the CRM module is an equally important part of every company’s supporting system. The CRM module for working with the client, recording activities, tasks, or automatic notifications about important client events is also a matter of course in this solution for our client. The module, which is the right hand of any investment professional or advisor, enables them to work more effectively with the client and can thus bring them the famous added value in the form of better service.

Industry specifics

One of the specifics of the financial industry is its very strong regulation and emphasis on security, continuous control or protection against the legalization of income from criminal activity. When developing any specific functionalities for our clients, we do everything we can to fully understand their practical needs and to familiarize ourselves with the specifics that characterize their industry or work. Therefore, we placed great emphasis on the development of functionalities for the Compliance Department and the Legal Department. One of the specifics is the regular AML (anti-money laundering) control, in which the system regularly evaluates the level of suspicion of individual client transactions and also detects the bank account from which the funds were credited to the client account. In case of suspicious transactions, the system alerts competent persons to be more careful with selected clients.

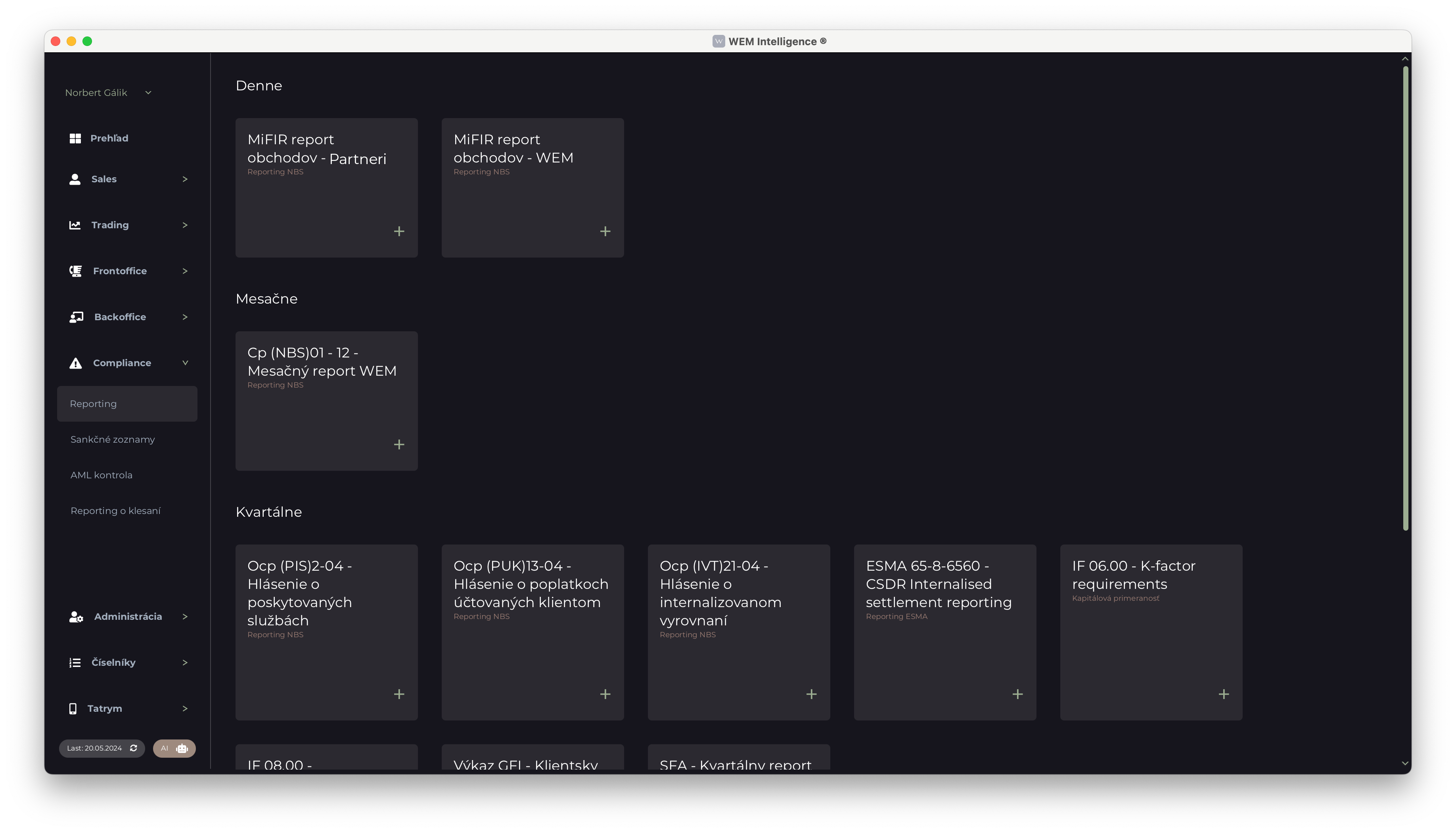

Part of the ongoing control of financial companies is also regular reporting for the regulator – usually the National Bank of Slovakia. Such reporting is carried out in various forms, whether it is a report in .xlsx or a report with a precise structure in .xml format. For our client, we therefore incorporated the possibility of regular generation of reports for the regulator in the form and format established by law, which involved a detailed study of the specifications of all reports and their incorporation into the system in the required structure. At the same time, we are also regularly cooperative in their modification in the event that a change in legislation requires it and our client is obliged to report some data in a changed form to the regulator. An example of such reports is the daily reporting of completed trades, the so-called MiFIR or reporting for CRS or FATCA financial management.

An application that grows with the client

The application is continuously developed and is thus always 100% adapted to the client’s requirements. In the event that the company decides to change processes, introduce new procedures or products, we customize the application so that it supports our client in their growth as much as possible and is able to provide the best possible service for their customers.

Our client’s complex software background also includes a B2B interface for their partners or a client zone for their clients, which you can read about in separate case studies.